Update regarding Overdue Notices email

Last month, we advised that over the coming weeks you would start receiving emails from Resolution Life advising you of clients who have:

• Missed a payment

• Are at risk of lapsing or

• Who have lapsed.

From 6th May 2024, if your clients fall into any of the criteria mentioned above, you will receive and Overdue Notices report email from Resolution Life.

Download an Overdue Notices sample email

Lifetrack policies will not generate a report.

If you are having issues with accessing this report, start an online chat with us via the portal.

Fee review for our investment products

Resolution Life has reviewed the fees associated with our account-based investment products. As part of this review, Resolution Life has removed the Switching fee for some products effective from 4 May 2024.

We are pleased to advise that the Switching fee has been removed for all Investment Linked plans.

If your client wishes to change their investment option, the Application for switching investment options form is available within the My Resolution Life portal.

This is just another way that Resolution Life is working hard to support your clients with their retirement needs.

Payment options for customers

The Make a payment webpage is a convenient way for your clients to submit payments into their account with us.

The current available payment options available are:

• Credit/debit card

Your client can use their credit or debit card to make a one-off payment to their policy online by clicking the link above.

Lifetrack policies currently don’t have this option.

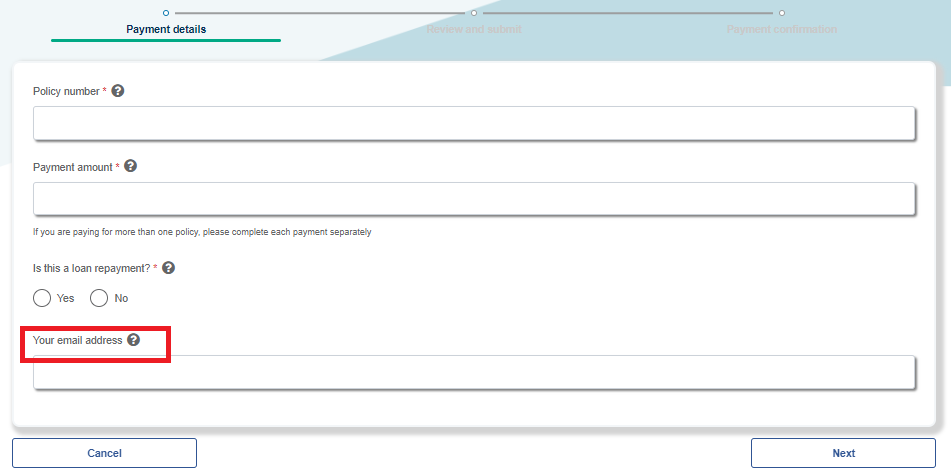

Previously, there was a mandatory requirement for clients to provide their email address as per below – this is no longer mandatory as not all clients have an email address.

• Internet banking

Your clients can make a one-off or regular payment using internet banking. There’s a helpful cheat sheet available to assist your clients on which products are eligible for internet banking.

• Via the My Resolution Life portal

Depending on your client's product, they may be eligible to make a payment via the portal. They can also update their payment frequency.

• By completing a form

Are you receiving our emails?

As we continue to enhance the My Resolution Life portal, email remains our primary mode of communication, as is the case for many financial institutions.

For this reason, we ask that you regularly monitor your spam or junk folders for any correspondence from us, to ensure that you receive all updates and notifications that are essential for you to service your clients.

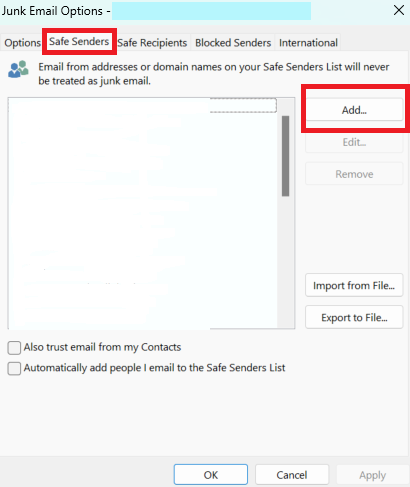

To ensure that you continue to receive emails from Resolution Life, you can add us to your Safe Senders List by following these easy steps:

1. On the Home tab, click Junk, and then click Junk E-mail options

2. On the Safe Senders tab, click Add and insert noreply@resolutionlife.co.nz

Note: the instructions above are specific to Microsoft Outlook.

What you need to know

Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life) is part of the Resolution Life Group. The content on this website is for information only. The information is of a general nature and does not constitute financial advice or other professional advice. Before taking any action, you should always seek financial advice or other professional advice relevant to your personal circumstances. While care has been taken to supply information on this website that is accurate, no entity or person gives any warranty of reliability or accuracy, or accepts any responsibility arising in any way including from any error or omission.